【ACT】Innovation and Entrepreneurship Course “The Road to Innovation and Entrepreneurship” Series Report 2 – Looking at New Venture Teams from a VC Perspective: What Preparations Should Be Made When Raising Venture Capital?

On the path of entrepreneurship, the greatest anxiety for entrepreneurs often comes from “pressure on capital”. For many people who want to start a business but are slow to do so, lack of capital becomes the biggest obstacle to their actions. For start-ups, the need to take responsibility for the success or failure of a company makes it critical to have better control over the capital flow of the business. Access to capital has thus become an important issue that no entrepreneur can ignore. For this reason, the “Innovation and Entrepreneurship” course within the ACT Global Program invited Mr. Ken Chuang, CEO of Rainmaking Innovation, to speak to the class on May 31, hoping that through his extensive practical experience, students could gain a better and deeper understanding of venture capital (VC).

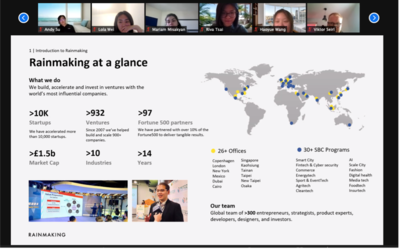

Rainmaking Innovation is an international startup accelerator platform that was set up in Europe 13 years ago. It has established, invested in, and accelerated nearly 1,000 new ventures in 10 major industry sectors with global resources, and is a key partner in strategic management partnerships with Global 500 companies. Rainmaking Innovation acts as a middleman between start-ups and companies, selecting investment targets according to the needs of the companies. To take the Taiwan market as an example, Fintech, Insurtech, Smart City, and AI are its recent main investment areas.

Mr. Chuang, who has seen many start-up businesses emerge and fall, shared with students the factors to which start-up teams should pay attention and for which they should prepare when raising venture capital, from the perspective of VCs:

What do VCs look for when investing in new ventures?

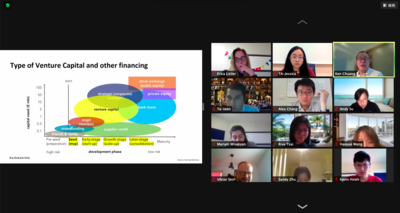

Mr. Chuang believes that “People, Market, and Technology” are the most important criteria for VCs when evaluating whether or not to invest. He explained that a start-up team must have the entrepreneurial spirit of commitment, integrity, and continuous pursuit of excellence. One of the important indicators when deciding whether to invest in a new team is the extent to which the team members get along with each other. A team that gets along well can go a long way, and vice versa. In terms of the market, VCs look for the ability of a start-up to generate sustainable recurring revenue and a financial plan for the next five years. Finally, regarding the product, the speaker reminded everyone to have a clear definition of their proposed product before proposing to VCs, be it Innovation or Invention, which should be clearly defined.

How does a start-up find the “right” investors?

In addition to innovative thinking and an executable business model, it is important for a good start-up team to have a solid understanding of investors' business movements. Before looking for an investor, they should analyze in detail the areas where different investors plan to invest for the year; before accepting an investment from an investor, they should find out whether the business organization has the resources they need. By doing so, they can find an investor that is more suitable for them and avoid being manipulated by the investor.

At the end of the speech, Taseen Saqeeb, a student from Bangladesh, asked the speaker, “Have you ever regretted not investing in a business? Have you ever felt regretful after investing in a business?” Mr. Chuang replied, “No regrets! My eyes are as sharp as an eagle’s, and I can find the next team that is more worthy of investment!” Before closing his speech, in addition to reminding students to learn how to promote themselves and create the value needed by venture capitalists, Mr. Chuang also cited a famous quote from Ellen Johnson Sirleaf: “If your dreams don't scare you, they’re not big enough!” in order to encourage students to embrace challenges and create unlimited possibilities.

(Written by Yen-Chu Lai from IBMBA / Edited by the College of Management)